Posthaste: 'Here comes the pain': Recession on tap for North America, BMO says

'Shallow' recession coming in first part of 2023

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

Good morning!

Both Canada and the United States are at risk of falling into a recession next year as central banks push interest rates higher to tackle stubborn inflation, according to the latest outlook from BMO Capital Markets.

“We believe the odds of a North American recession are greater than even,” said Sal Guatieri, senior economist at BMO Capital Markets, in a note titled “Here comes the pain again.”

Economists at the bank expect Canadian gross domestic product to fall more than three percentage points next year amid deteriorating financial conditions brought on by a crumbling housing market, a weak stock market and more interest rate increases. Lower prices of oil and gas and other commodities will also take a toll on Canada’s growth. In the U.S., GDP is expected to fall by two percentage points next year. The contraction in both countries will be centred in the first half of the year, in what Guatieri called a “shallow recession.”

Falling home prices are one factor at play in the coming downturn, and have already sheared off growth in both countries. But the damage isn’t over yet. BMO expects prices to slide a total of 20 per cent in Canada and 15 per cent in the U.S. before the market stabilizes, adding further pressure to the economy.

Meanwhile, interest rate hikes will continue to cause pain. BMO thinks the Bank of Canada will keep raising rates more than originally anticipated, bringing them up another 75 basis points before pausing at 4.5 per cent for the benchmark. The U.S. Federal Reserve will follow a similar path, with rates peaking between 4.75 and five per cent.

At the same time, flush household savings accounts, which helped fuel growth after pandemic lockdowns, are unlikely to save the day this go around. Many people are likely scraping the bottom of the barrel at this point, after deploying their savings to pay for the rising cost of living and higher debt costs. “No cavalry is around the corner to rescue the economy or markets,” Guatieri said.

But just how far the economy slides depends on how fast inflation falls back to its two per cent target. So far the rate has proved stubborn, and economists aren’t sure it will cool very quickly, meaning inflation might still come in at three per cent on a year-over-year basis even into the latter months of 2023.

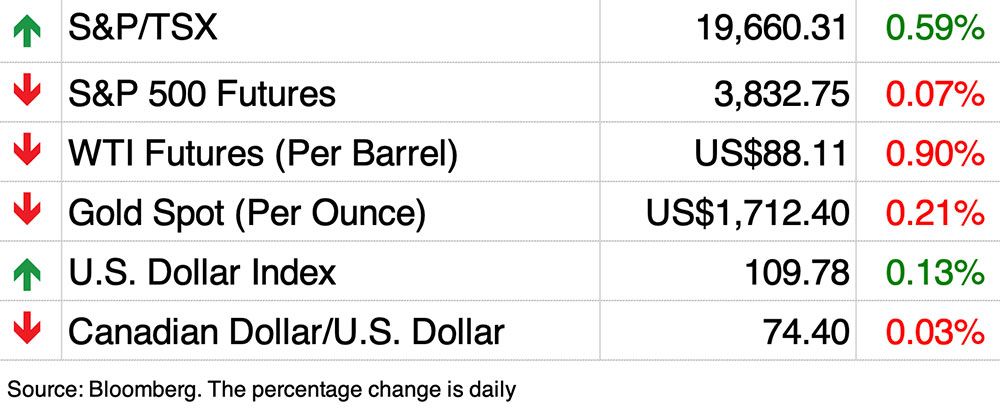

To add to the pain, a low Canadian dollar could further fuel price increases. BMO expects the loonie to sink even more, hitting 72.5 cents U.S. by the end of 2023. There are other geopolitical risks to watch out for, too, including the continued conflict in Ukraine and strained ties between the U.S. and China, BMO said. Added together, it signals North America is walking straight into a downturn.

The forecast won’t come as news to most Canadians, who are feeling gloomy about the economy’s prospects. More than half, or 55 per cent, think the country is in a recession already, and another 68 per cent believe we’ll enter one in 2023, according to one survey released this morning from IG Wealth Management. Other consumer polls back up the pessimistic view. Maru Public Opinion’s Canadian household outlook index fell to 87 in October from 93 in September, a six-point drop. John Wright, Maru’s executive vice-president, called it “the bleakest and most biting outlook” he’s ever seen.

Still, there is good news for those bracing for tough economic times. Guatieri said BMO isn’t expecting the coming recession to be a lasting one, and said relief will come fairly quickly.

“The downturn is likely to be moderate and short-lived,” he said.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

Hybrid work is gaining in popularity in Canada, data from Statistics Canada released Friday shows. One in 10, or 1.7 million workers, split their time between the office and home in October, according to the latest Statistics Canada labour force survey. That’s a rise of 5.4 percentage points since January 2020, and a gain of 0.4 percentage points since September.

Almost ever industry saw a greater share of workers splitting their time between the office and alternate locations from January to October. But knowledge workers made the biggest gains, with the finance, insurance, real estate, rental and leasing sectors growing the most. Meanwhile, exclusively working from home has declined as more people flock back to offices, Statistics Canada said.

___________________________________________________

- Labour Minister Seamus O’Regan Jr. will highlight the 2022 fall economic statement, the government of Canada’s plan to continue making life more affordable for Canadians and building an economy that works for everyone

- Marci Ien, minister for women and gender equality and youth, will highlight the 2022 fall economic statement, the government of Canada’s plan to continue its sound stewardship of the economy, make life more affordable and build an economy that works for everyone

- Eric Girard, Quebec minister of finance, will announce a measure to help Quebecers

- Canadian Heritage Minister and Quebec Lieutenant Pablo Rodriguez will announce the booksellers that will receive funding from the government of Canada’s new Support for Booksellers component of the Canada Book Fund

- Brookfield Asset Management Inc. to hold a shareholder meeting to vote on a plan to distribute a 25 per cent sake in its asset management business to shareholders

- Transport Minister Omar Alghabra; Chad Collins, Liberal MP for Hamilton East—Stoney Creek; Lisa Hepfner, Liberal MP for Hamilton Mountain; and Ian Hamilton, president and CEO of the Hamilton-Oshawa Port Authority, will make a funding announcement

- Foreign Affairs Minister Melanie Joly will join the Asia Pacific Foundation of Canada and the Munk School of Global Affairs & Public Policy to discuss Canada’s work to expand partnerships and deepen ties within the Indo-Pacific region

- Ontario Premier Doug Ford and Caroline Mulroney, Ontario minister of transportation, will make an announcement

- Jaime Battiste, Liberal MP for Sydney—Victoria, will make a geothermal capacity-building announcement with Net Zero Atlantic in Sydney, N.S.

- “Advancing Indigenous women entrepreneurs in Alberta” will bring close to 200 Indigenous and non-Indigenous entrepreneurs, artists, innovators, and sector leaders together to celebrate Indigenous women entrepreneurs, examine the opportunities and barriers they face and share conversations on reconciliation, decolonization and the importance of a building an inclusive innovation ecosystem

- Deputy Prime Minister and Finance Minister Chrystia Freeland speaks to Calgary’s business community

- Environment and Climate Change Minister Steven Guilbeault will attend the High-Level Ministerial Dialogue on the New Collective Quantified Goal on Climate Finance at COP27

- Today’s data: U.S. wholesale trade

- Earnings: TC Energy Corp., Manulife Financial Corp., Rogers Communications Inc., Kinross Gold Corp., MEG Energy Corp., Aimia Inc., Vermillion Energy Inc., Linamar Corp., Brookfield Renewable Corp., Honda Motor Co. Ltd., Nissan Motor Co. Ltd., Choice Properties Real Estate Investment Trust, Leon’s Furniture Ltd., Trican Well Services Ltd., Fiera Capital Corp., High Liner Foods Inc.

___________________________________________________

_______________________________________________________

- ‘This is the evolution of energy’: Ottawa and Alberta kick in $461 million for clean hydrogen facility

- Avoid these five mistakes when estate planning to preserve family peace

- If Ukraine falls to Russia, Estonia is next: Bill Browder

- Canada ruffles some feathers at COP27 by including oil and gas representatives in its delegation

- Peter Hall: Why so many forecasters were dead wrong on inflation

- Quiet quitting is picking up speed as workers tune out from their jobs

- Gold Fields terminates Yamana takeover deal, paving way for Agnico and Pan American

____________________________________________________

Rather than perpetuating the doom and gloom in the news about rising interest rates and inflation, it might be more useful to discuss solutions. After all, we don’t have any control over the increased costs and there’s only so many things we can cut out of our budgets, so a better tactic would be to start thinking about how to increase our income. In her latest column, Sandra Fry looks at ways to bring more money in by embarking on a side hustle.

____________________________________________________

Today’s Posthaste was written by Victoria Wells (@vwells80), with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.