Alberta insolvencies on the rise as COVID relief comes to an end

Chances are, insolvencies will continue to climb in 2023 as the economy catches up with interest rate hikes

Article content

Insolvencies in Alberta have returned to pre-pandemic levels after almost three years of lowered rates.

The latest statistics show 1,402 insolvency filings in the province in November, the most since March 2020 when there were 1,492. There were also 1,402 in February of 2020. Filings dropped to 1,000 in April 2020 as pandemic-related support programs such as CERB began to come online.

And insolvencies are expected to continue to climb in 2023.

“I think this number will probably go up even over the next few months,” said Anupam Das, an economics professor with Mount Royal University. “The economy is slowing down. Although the main reason that the central bank was increasing the interest rate was to curb inflation, however, there is no sweet spot. These kind of contractionary policies generally have impacts on goals and unemployment and insolvencies.”

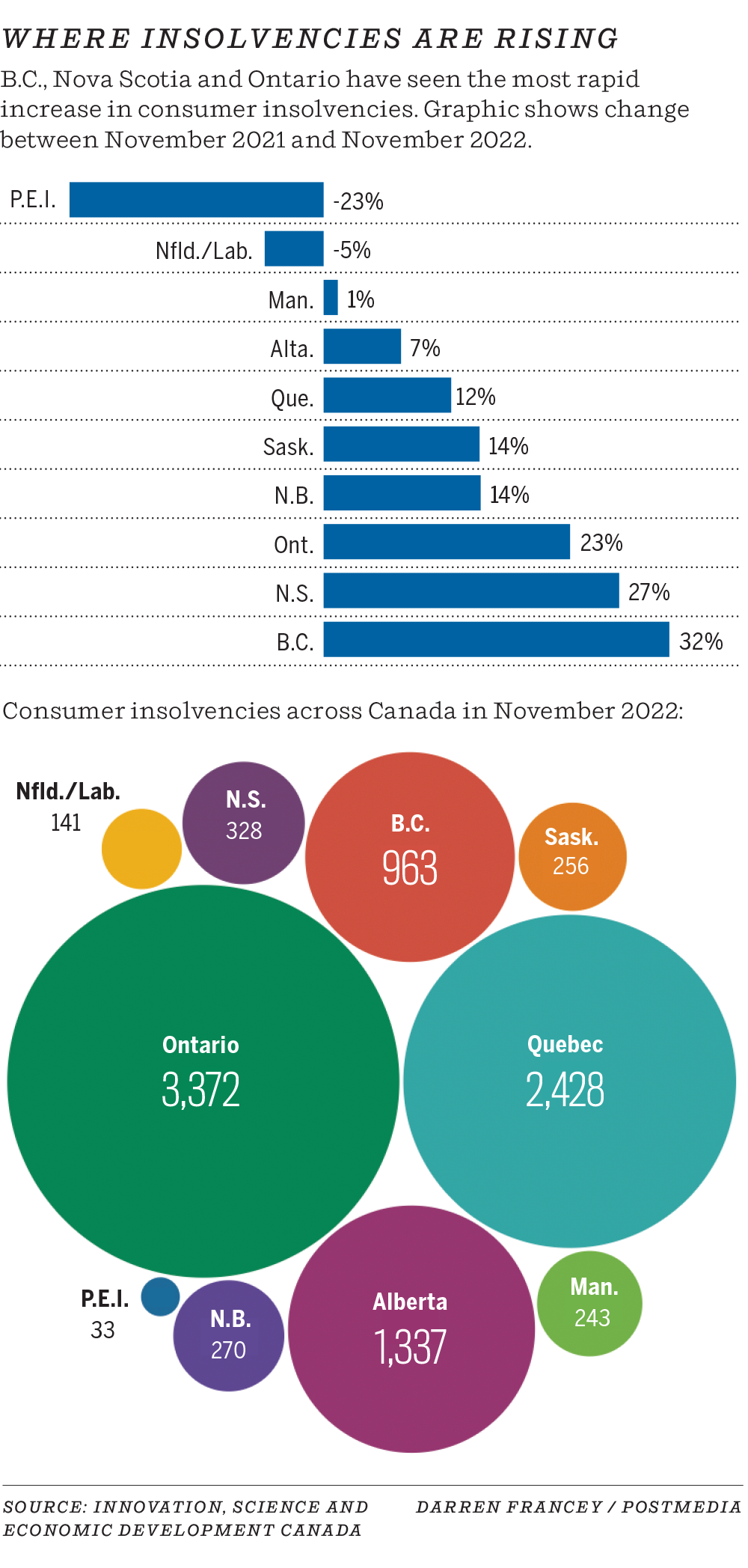

Alberta’s numbers are in line with national increases, which are also hitting levels not seen since March 2020. Canada-wide there were 9,784 insolvencies filed in November, an increase of 7.3 per cent month-over-month and 17.5 per cent year-over-year. In the past 12 months there have been 102,619 insolvencies, up 10.2 per cent.

The bulk of all insolvencies are by consumers. In Alberta, there were 1,379 consumer insolvencies, including 220 bankruptcies, filed in November. It’s an increase of 12 per cent in both cases month-over-month, and 10.4 per cent year-over-year for insolvencies. Bankruptcies are actually down 15.1 per cent year-over-year over the 12-month time frame.

Filings in Alberta bottomed out at 881 in August 2020, and fluctuated between 900 and 1,200 a month over the next 18 months.

While insolvencies have been growing for much of the past year, a big spike occurred in March, going from 1,183 to 1,371 in Alberta, an increase of 15.9 per cent. This coincides with rampant inflation and the Bank of Canada beginning its series of interest rate hikes. Inflation continued to grow through the summer before plateauing over the final few months of the year, while the overnight interest rate target has gone from 0.25 per cent to 4.25 per cent.

According to an Equifax report from March, Albertans had the highest average consumer debt in the country at $25,172, excluding mortgages.

Michelle Statz, a licensed insolvency trustee with Bromwhich+Smith, said they have been waiting for the other shoe to drop in the wake of the expiration of financial pandemic supports.

Insolvency rates were growing before the pandemic. Canada has some of the highest consumer debt levels in the developed world, rising from $1.75 of debt per dollar earned in 2019 to $1.83 in 2022.

Programs such as CERB and loan deferment initiatives helped curb insolvency rates during the pandemic, but those financial issues generally did not go away for those struggling to make ends meet.

“As trustees, we have been speculating since then when are they going to increase, because at some point that’s not sustainable,” she said. “At some point there’s going to be some kind of stressors that impact this and we’re going to see insolvencies go up.”

Statz also said these rates are likely to continue to rise with an economic slowdown or recession, and suggested visiting an insolvency trustee can present options to consumers.

Das said those most affected are generally the most vulnerable, those already living on the financial fringes.

Premier Daniel Smith in November announced a number of measures to address inflation, including the reindexing of social support programs such as AISH and reindexing income tax levels. Das said this will help but only to a point.

“If people do not have enough income, their taxes will be low to begin with,” he said. “I think it’s important that people actually get a sufficient level of income so that they can run their families, they can run the household.”

Twitter: @JoshAldrich03

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.